Extended Qualitative Analysis – Pfizer

Fact Sheet Pfizer

Foundation: 1849 by Karl Pfizer

CEO: Ian Read

Corporate Headquarter: New York, USA

Revenue (2013): US$ 51.58 billion

R&D Expenses (2013): US$ 6.68 billion

Market Capitalisation (2012): US$ 157.81 billion

Employees (2012): 90,000 in more than 80 countries

Industry: Human Medicine, Consumer Health Care

Summary

This post shows a detailed qualitative in-depth analysis of Pfizer in order to get a better feeling of how this company works and where strengths and weaknesses can be found.

1 Analysis of Pfizer

1.1 General Characteristics of Pfizer

Pfizer is one of the world’s leading pharmaceutical companies, and the leading one in the US market. The research-based American company mainly operates in two areas, the human medicine industry, and the consumer health care industry. Key products of Pfizer are for instance Lipitor, Viagra, Xanax, ThermaCare and Centrum. Pfizer’s principal market for the Common stock is the New York Stock Exchange; Pfizer is further listed on the London, Euronext and Swiss Stock Exchanges, as well as on various regional stock exchanges of the United States. In 2012, Pfizer possessed a market share of 6.6% of the US market for pharmaceuticals. Its main competitors are Merck & Co Inc (6.3%), Novartis (6.0%), and Astrazeneca (5.7%). Pfizer operates in more than 80 countries worldwide, in the advanced market countries (e.g. US, Germany, Austria, and UK), as well as in the emerging and developing market countries (e.g. Brazil, Argentina, and Russia).

1.2 Mission, Vision & Strategic Goals

Pfizer perceives itself as a Corporate Citizen, whose task not only consists of developing innovative medicine, but also of ensuring the accessibility of this medicine for all humans. From the information given on the company’s website, the following mission statement can be formulated:

“Pfizer uses science and its global capabilities, in order to improve health and quality of life in every stage of life – Working Together for a Healthier World.”

Pfizer’s business vision is “to innovate to bring therapies that significantly improve patients’ lives”. In order to fulfil this vision, the company focusses on Research & Development and works to translate advanced technologies and sciences into the therapies that matter most for the patients.

Pfizer has four major strategic goals: innovation and leading, maximizing value, earning greater respect and the ownership of their work. In order to achieve the first goal of innovation and leading, the company seeks to improve the ability to innovate in Research & Development, and wants to continue developing high-value and highly differentiated vaccines and medicines. To maximize value, Pfizer invests and allocates resources adequately to create greatest long-term return for shareholders. That means that Pfizer concentrates itself on its core business and sold, for instance, its Nutrition and Animal Health Business recently. They further introduced a company wide program to reduce expenses. The goal of earning greater respect includes the aims of generating break-through therapies, improving access to the market and fighting against counterfeit and substandard medicines, expanding the dialogue on health care and, as already mentioned, acting like a responsible Corporate Citizen. The fourth strategic goal mainly concerns internal issues and consists of building and sustaining a culture of entrepreneurship, as well as establishing a team culture within the corporation.

1.3 SWOT Analysis

1.3.1 Strengths

One of the main strengths of Pfizer is the company’s’ experience in over 150 years Research & Development, providing a broad therapeutic coverage. Pfizer’s product pipeline currently consists of 82 projects at different stages of development. Furthermore Pfizer possesses a strong market position with high sales and a solid marketing infrastructure. Another strength of Pfizer is the high amount of strategic agreements and mergers & acquisitions, which increase the portfolio, the brand reputation and lead to an improvement of know-how and further resources. For instance, Pfizer possesses various research agreements with competitors such as Merck & Co. Finally, the corporation benefits from a strong brand image; this image is especially generated by Pfizer’s blockbuster products like Viagra, Lipitor and Lyrica. Thus, Pfizer is defined by adequate usage of its internal resources and smart choices of valuable partnerships.

1.3.2 Weaknesses

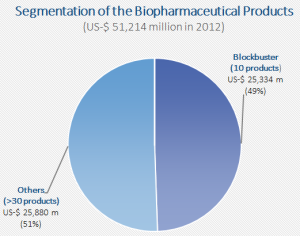

Pfizer’s main weakness lies in its strong reliance on the blockbuster portfolio that generates almost a half of the overall sales. As it is shown in the graphic, the blockbuster products, such as Lipitor and Viagra, accounted for 49% of the revenues of biopharmaceutical products, which in turn generated 94% of Pfizer’s overall revenues in 2012.

Figure 1: Segmentation of the Biopharmaceutical Products

Figure 1: Segmentation of the Biopharmaceutical Products

This weakness is strongly connected to the following one, the expiration of patent rights. The loss of exclusivity has an important impact on all of Pfizer’s products, but especially on their blockbusters. Patent expirations cause a loss of technological advance for Pfizer, since competitors will immediately penetrate the markets with generic products. Thus, the sales will significantly decrease, as well as the prices for the respective products. This was, for instance, the case for the blockbuster product Lipitor, when its patent expired in 2011. Lipitor revenues decreased from US$ 9.6 billion in 2011 to US$2.3 billion in 2013. Unfortunately, Pfizer is not able to develop new compounds at the same rate at which patents are expiring. In addition, Pfizer does not produce enough low-cost pharmaceuticals, to firstly penetrate the markets with generic products and, secondly, to be independent on economic downturns that in most cases lead to a higher demand of these generic compounds.

A further weakness is the stagnation of Pfizer’s business units. As presented in the adjoining table, the most profitable business units, Specialty Care and Primary Care, show decreasing revenues.

Figure 2: Revenues per Business Unit

Figure 2: Revenues per Business Unit

The business unit Emerging Markets shows only a slight increase and Established Products is again characterized by falling sales. High increases can only be registered for the two business units with the lowest revenues. This stagnation and decrease of revenues in the most important units could be interpreted as an inability to invent new and profitable products. Pfizer should invest and focus on growing markets to ensure a balanced market penetration to react better on customer needs and to compensate shocks.

1.3.3 Opportunities

The emergence of new markets as well as new market segments represents one big opportunity for Pfizer. From a demographic point of view, the continuously ageing society, as well as the fast growing emerging markets will significantly contribute to an increase in the demand of pharmaceutical products. Moreover, Pfizer could expand its activities in the production of generic compounds to further diversify its product portfolio and become more independent from external shocks. Due to the high investments in Research and Development, the future development time, as well as the cost of production will likely decrease. The R&D agreements with health institutes and competitors will also be favourable for this development. In addition, a rising awareness about healthcare needs can be expected and will also ensure a growing demand of biopharmaceutical and customer healthcare products. Due to this rising awareness, the demand for high quality therapies is likely to increase as well.

1.3.4 Threats

As already mentioned, Pfizer is highly dependent on external effects. This includes government control and healthcare regulations. Since the sales in the United States count for almost 40% of the overall revenues, especially reforms in the American Healthcare system could have significant impact on Pfizer’s business, e.g. in terms of pricing and access restrictions for its products. For instance, an increase in the minimum rebate on branded prescription drugs within the U.S. Healthcare Legislation will affect the 2013 revenues ex post by a reduction of US$ 458 million, according to the Financial Report of 2013. Moreover, the expiration of patents is also a considerable threat since it causes high competition through generic pharmaceuticals. Furthermore, national and international competitors could launch similar products, even earlier than Pfizer, which represents another threat. Both of these threats lead to price decreases and thus potential losses in Pfizer’s revenues.

1.4 Boston Consulting Group Matrix

In the following paragraphs, the Boston Consulting Group matrix will be used to show the current market position of several top-selling products of Pfizer, their blockbusters. Since information regarding the products’ market shares is difficult to obtain, a complete BCG-analysis could not be conducted.

- Lyrica: This medicine is indicated for the treatment of neuropathic pains. The product showed the highest increases in revenues within the Pfizer portfolio in 2013 (+11% in comparison to 2012). It has a comparatively high market share of approximately 34%. Its patent rights will not expire until 2018, so it Lyrica will likely maintain a blockbuster position in the upcoming years.

- Enbrel: This product is used for the treatment of moderate-to-severe rheumatoid arthritis and is the second best-selling medicine worldwide in this segment. However, Enbrel’s total revenues increased by only 1% in 2013. In the U.S. and in Canada, the sale is based on a co-promotion agreement between Pfizer and Amgen, which expired in the end of 2013. Therefore, Pfizer will only receive royalties in the following 2 ½ years, and will not be entitled to any further revenues from Enbrel in the U.S. and in Canada. Nevertheless, since revenues from the rest of the world are solid, the market share is high and the growth relatively low, Enbrel can be considered as a cash cow.

- Viagra: In 2013, total revenues of Viagra decreased by 8%. This development is mainly due to the entry of generics in the European market, since Viagra lost exclusivity in these markets in mid-2013. But since it is the most recognized treatment for erectile dysfunction in the world, it still possesses a market share of approximately 45%. Viagra has a high brand reputation and generates solid revenues within the Pfizer portfolio; thus, it can be considered as a cash cow.

- Lipitor: This pharmaceutical is used for the treatment of elevated LDL-cholesterol levels in the blood. Since the expiration of its patent rights in 2011, the market share of Lipitor significantly dropped to currently approximately 4%. Lipitor faces strong generic competition in all major markets. Its total revenues decreased by 41% from 2012 to 2013. But since it is still generating over US$ 2 billion of revenues, it can be considered as a cash cow with slow tendency of becoming a poor dog.

- Zyvox: Zyvox is the world’s best-selling branded agent for treatment of Gram-positive pathogens, including methicillin-resistant staphylococcus-aureus. Its market share amounts to almost 50%. However, total revenues increased by only 1% in 2013. Zyvox will not lose exclusivity before 2015. Therefore, further solid revenues will be generated until then. It can be considered as a cash cow with some characteristics of a star in emerging markets, since the growth in emerging markets strongly contributed to the total increase of revenue.

- Sutent:This pharmaceutical is indicated for the treatment of renal cell carcinoma and various tumours. Even if total revenues decreased by 3%, it can be considered as the most important star within Pfizer’s biopharmaceutical product portfolio. Sutent is market leader in its segment and is still under patent protection until 2018. Thus, it will most likely generate significant revenues in the upcoming years.

1.5 PEST Analysis

1.5.1 Political and Legal Factors

Pfizer, as a pharmaceutical company, is strongly dependent on a countries healthcare system. Since Pfizer operates globally, it has to overlook and take into consideration political and legal factors from all over the world. Since the healthcare system of many countries is mostly public, government sponsored, political factors will impact the government’s expenditures in healthcare, as well as determine guidelines and quality standards for pharmaceutical products.

As Pfizer is an American corporation and the domestic market is the company’s key market, Pfizer is especially affected by the U.S. Healthcare Legislation. The Patient Protection and Affordable Care Act, which was enacted in 2010 in the U.S., resulted in both short and long-term impacts on Pfizer. Some of the new regulations that will influence Pfizer’s business are mentioned below:

- “An increase, from 15.1% to 23.1%, in the minimum rebate on branded prescription drugs sold to Medicaid beneficiaries (effective January 1, 2010);

- extension of Medicaid prescription drug rebates to drugs dispensed to enrollees in certain Medicaid managed care organizations (effective March 23, 2010);

- discounts on branded prescription drug sales to Medicare Part D participants who are in the Medicare “coverage gap,” also known as the “doughnut hole” (effective January 1, 2011); and

- a fee payable to the federal government (which is not deducible for U.S. income tax purposes) based on Pfizer’s prior-calendar-year share relative to other companies of branded prescription drug sales to specified government programs (effective January 1, 2011, with the total fee to be paid each year by the pharmaceutical industry increasing annually through 2018).”

These new regulations will not only impact future revenues, but also will affect the financial results of the years 2011, 2012 and 2013. In most cases, they cause a reduction of revenues. Regulatory reforms of the U.S. healthcare system are still in process and will be implemented continuously, which leads to access pressures for Pfizer.

According to Pfizer’s Financial Report 2013, not only government actions affect the company’s business, but so do health insurers and benefit plans. They limit access to certain of Pfizer’s pharmaceuticals by imposing formulary restrictions in favour of the increased use of generic compounds.

Another important legal issue is the one of intellectual property rights, which was already mentioned. Many of Pfizer´s compounds have multiple patent rights that expire at varying dates. Once the patent protections expire or are lost prior to the expiration date as a result of a legal challenge, Pfizer loses the exclusivity of these products and will face strong competition from generic pharmaceutical manufacturers. These manufacturers usually produce similar products and offer them at lower price levels. This results in decreasing revenues for Pfizer, often in a very short period of time.

1.5.2 Economic Factors

Pfizer continues to face a challenging economic environment, which impacts its operations worldwide. Pfizer believes that an economic environment with high unemployment rates and salary cuts leads to an increasing number of patients who switch to generic products, delay their treatments, skip doses or use less effective treatments in order to reduce their costs. Such a situation resulted from the financial crisis of the recent years. Especially in the U.S., the economic decline further caused an increase of the number of Medicaid members whose access to brand-name drugs is limited in some U.S. states and who benefit from high rebates on pharmaceutical products.

Moreover, since Pfizer is a globally operating company, foreign exchange rates are of significant importance for the company’s revenues, earnings, and substantial international net assets. Pfizer operates in more than 100 foreign currencies (e.g. Euro, Japanese Yen). Changes in those foreign currencies relative to the U.S. dollar can strongly impact the corporation’s results and their financial guidance.

However, the pharmaceutical industry as a whole is less dependent on the economic situation in terms of systemic risks, since pharmaceutical products will always be necessary. But Pfizer should focus on a higher production of generic pharmaceuticals, to avoid the risk of revenue decreases in times of economic downturns and crises. Moreover Pfizer’s operations are affected by a country’s inflation rates in terms of sales prices, cost of goods sold and wages.

1.5.3 Social Factors

Social factors significantly impact the operational results of Pfizer, since pharmaceuticals are generally produced for human beings. Thus social changes will influence the pharmaceutical industry. Such factors are, for instance, the population growth rate and the ageing society. An increasing awareness of healthcare could have an impact on Pfizer in both ways, negative as well as positive. If people become more aware of possible side-effects of drugs they might buy other pharmaceuticals. On the other hand, a higher healthcare awareness will increase the demand for high quality pharmaceuticals and will therefore result in higher revenues for Pfizer. Further social factors, which appear globally, “such as eating habits, increased automation, changing lifestyle (due to economic growth), will continue to cause chronic diseases.” One of the main threats for the healthiness of the population is the increasing rate of obesity. Obesity can as well result in chronic diseases, for instance diabetes. This is not only a problem of developed countries anymore, but also of the emerging ones. As a result, two tendencies can be observed, on the one hand the ageing society and the growing awareness of healthcare, and on the other hand the increasing amount of chronic diseases. Those developments will, however, positively influence Pfizer’s performance in terms of growth and revenue.

1.5.4 Technological Factors

The technological development in the modernized world will provide the pharmaceutical industry with new business possibilities both in terms of further service provisions and new therapy and treatment systems. Pfizer could benefit from new information and communication technologies, healthcare presence on the social media platforms, and pharmaceutical treatments could become more customized. Further, the Research and Development activities of the corporation will be significantly influenced of new innovations in pharmaceutical research methods and machines.

1.6 Survey of Investment Attractiveness

Pfizer offers a large range of products in a high potential market. The growing population, obesity, demographic changes as well as many more of today’s issues create opportunities for the pharmaceutical market. In addition, Pfizer invests a lot in R&D to develop new medicines. Due to the patent expiration of its blockbuster Lipitor, Pfizer’s revenues declined last year. However, within the next five years, several new products are expected to be launched, ensuring the companies’ future growth. Pfizer proves to be more financially attractive than its main competitors Johnson&Johnson, Norvatis and Merck Inc.

Figure 4: Financial indicators of attractiveness

Figure 4: Financial indicators of attractiveness

The table shows, that Pfizer improved its financial indicators much more than its main competitors. The share price and dividend per share have grown. Secondly, the earning per share (EPS) and the return on equities have increased, which indicates an improvement of Pfizer’s profitability. Furthermore, the PE Ratio enables to judge about the company’s value. When the PE ratio is high, it indicated that the share price is overvalued. It should be noticed that Pfizer has the lowest PE ratio, showing stability and low risks. Finally, the dividend coverage of Pfizer is the highest, which proves that Pfizer has the less difficulties in paying off its preferred dividend payments compared to it competitors.

In conclusion, investments in Pfizer are currently very attractive, since it offers high potential for growth in the next years.

1.7 Influence of Internal Factors

Pfizer implies several internal factors which influence its investments. The most important are the influence of the marketing strategy, the R&D, the system of information management, the efficient financial strategy and human resources.

1.7.1 Influence of a Strong Marketing Strategy

The quality of Pfizer’s products and their high differentiation enables Pfizer to be one of the biggest companies in the pharmaceutical industry. Pfizer has a strong marketing strategy (more detailed in section 1.10), which helps to ensure a sustainable profitability.

1.7.2 Influence of R&D

Its R&D capabilities are Pfizer’s key to success. To keep a competitive market share, Pfizer spends more than a fifth of its total revenues in R&D each year. Product development is a very long-winded process in the pharmaceutical industry. On average, 20 years per new patent are needed. The patents, resulting from extensive R&D, give investors confidence in Pfizer’s long-term stability.

1.7.3 Influence of Information Management System

The information management system is important for making decisions. It is not only essential for any internal decision processes, but can also be used by (potential) investors. Consequently, Pfizer tries to ensure a high degree of transparency as well as high quality information.

1.7.4 Influence of Efficient Financial Strategy

Pfizer has positive ratios to support investments (see part 1.12). Moreover, Pfizer maintains a good relationship with its shareholders.

1.7.5 Human Resources

Pfizer’s success is attributed to the competences of its management team and the employees. In addition, Pfizer has been placed among the top 50 of the World’s Most Attractive Employers, which enables the corporation to attract skilled and qualified people from all over the world.

1.8 Marketing Analysis

Pfizer possess a strong marketing strategy in order to gain advantage over its competitors. The following marketing mix explores how the company achieves competitive advantage.

Pfizer offers a variety of health care products. Pfizer’s products have a brand name, which stands for excellence in the pharmaceutical industry. The portfolio includes human, animal biologic, small molecule medicines and vaccines. The high level of quality that Pfizer promises is integrated in the values and the work culture of the company. In order to offer high quality products, the safety and tolerability of its products are of main concern. Pfizer also offers strong and durable packaging. The quality of products enables Pfizer to achieve a competitive advantage in product differentiation.

1.8.1 Product

Pfizer sells diversified products. 173 drugs manufactured by Pfizer are currently sold on the market. The company promises a high quality of products and their packaging.

1.8.2 Place

Currently Pfizer operates in 120 countries. The products are sold in selected local distributors (i.e. pharmacies and hospitals). To prevent counterfeiting, Pfizer pays much attention to the distribution process and channels.

1.8.3 Price

Due to the high quality, Pfizer follows a high price strategy. Indeed, Pfizer spends a lot in R&D and has high production and distribution costs. As a result of patent expirations in recent years, Pfizer had to raise prices. By increasing the prices of old products, Pfizer encourages customers to switch to its new products.

1.8.4 Promotion

Pfizer’s sales force targets professionals in health care (i.e. doctors, clinics). In addition, Pfizer promotes its brands through advertisements in newspaper (more B2B) and television (more B2C). Besides Pfizer also does promotion online (i.e. website, social networks).

1.9 Product Analysis

Pfizer manufactures pharmaceutical products which are divided in the following categories:

- Biopharmaceutical Products

- Primary Care

- Human Pharmaceutical Products

- Specialty Care

- Prescribed Human Pharmaceutical Products

- Vaccines

- Generic Pharmaceuticals

- Oncology and Oncology-Related Products

- Consumer Healthcare

- Non-Prescription Medicines and Vitamins

- Animal Healthcare

- Parasiticides

- Anti-Inflammatories

- Antibiotics

- Vaccines

- Antiemetics

In spite of Pfizer counting 173 different products, the main profits are related to sales of its 10 blockbusters. The current blockbusters are: Lipitor, Plavix, Nexium, Abilify, Advair, Seroquel, Singulair, Crestor, Cymbalta and Humira.

Lifecycle Analysis of Pfizer’s Products:

Introduction stage: ABOVE-5 (Antacid) ABOVE-5D, DOLONET (painkiller). A lot of marketing and sales activities are carried out for these products.

Growing stage: BECOSULE-Z vitamin B complex, Lyricica, Premarin famiy, Prevenar family.

Maturity stage: Most of their products.

Declining Stage: DAXID an antidepressant, BMP2, and Lipitor. Pfizer lost their patents, consequently new products have taken their place.

To sell a new, successful pharmaceutical product in the market, the development of almost 20 is needed. Thos enables pharmaceutical companies to have a long product life cycle. However, Pfizer currently suffers from an imbalance, since most of Pfizer’s products are in the maturity stage. In conclusion more products are needed in the introduction and growing stage to balance the turnover. Pfizer plans to launch 15 to 20 new products in the upcoming years.

1.10 Financial Analysis

To analyze the financial health of Pfizer, the key financial indicators will be presented in the next section.

1.10.1 Revenues

Total revenues were $59.0 billion in 2012, a decrease of 10% compared to 2011, due to the negative impact caused through losses of exclusivity such in the case of Lipitor. In addition they were an unfavourable impact of foreign exchange, which decreased revenues by approximately $1.5 billion, or 2%.

1.10.2 Key Ratios of Profitability

The Return on Assets (ROA) of Pfizer has strongly increased since 2010. This indicates that the company efficiently generates earnings from invested capital (assets).

Figure 5 : Return on Assets 2007-2013

Figure 5 : Return on Assets 2007-2013

1.10.3 Indicator of performance, ROS and ROCE

ROE and ROCE are important indicators of performance:

- The ROE (Return of equity) analyses the profitability related to a company’s common equity.

- The ROCE enables to measure the company’s profitability and the efficiency with which its capital is employed. Unlike ROE, ROCE considers debt and other liabilities.

Though positive, Pfizer’s efficiency in growth was unstable, as well as the efficiency in its use of capital.

Figure 6: ROS and ROCE 2008-2012

Figure 6: ROS and ROCE 2008-2012

The proportion of Pfizer’s debt in relation to equity finance increased. However, it is still among the industry average, which is appropriate. The healthcare industry does not display a high amount of debt, which exposes the companies to fewer risks in terms of increasing interest rates or credit ratings.

Figure 7: Debt to Equity Ratio 2008-2012

Figure 7: Debt to Equity Ratio 2008-2012

1.10.4 Liquidity Ratio

In the last five years, Pfizer has always been able to pay back its current liabilities with cash and quick assets.  Figure 8: Quick Ratio Comparison (Acid Test) 2008-2012

Figure 8: Quick Ratio Comparison (Acid Test) 2008-2012

1.10.5 WACC

WACC of Pfizer reached 9,70% in 2013. It is slightly higher than the WACC of the industry of 8,8%. This indicates higher risks and a lower valuation of Pfizer compared to the healthcare industry as a whole, which reflects Pfizer’s current transition, due to patent expirations and uncertainty of new products’ success.

To summarize the financial data, Pfizer has faced several issues in this past years, but is getting back on track. The efficiency, the performances and profitability have been improved. However, Pfizer’s current product portfolio is unbalanced concerning product life cycles, which increases risks.

2 Development of the Investment Strategy

2.1 Ansoff Matrix

As the largest pharmaceutical company in the world, Pfizer is continuously trying to improve its portfolio. In order to give insight into those portfolio changes and the direction Pfizer is taking right now, we took into account the past five years (2009-2013).

2.1.1 2009

The acquisition of Wyeth, a large US pharmaceutical company, for 68$ billion in the end of 2009, enabled Pfizer to grow its business significantly (market penetration). Besides improving its portfolio in areas where Pfizer already well established (oncology, pain, inflammation, Alzheimer’s disease, psychoses and diabetes), the acquisition also increased Pfizer’s emphasis on biotherapeutics and vaccines.

In connection with the acquisition, both Pfizer and Wyeth divested some of their animal health assets. They sold them to the German drug manufacturer Boehringer Ingelheim. The products being divested primarily include cattle and small animal vaccines and some animal health pharmaceuticals(consolidation). Furthermore, engaged in a joint venture with GlaxoSmithKline (the fourth biggest pharmaceutical company worldwide) to create ViiV Healthcare. This new company brings together the industry’s best assets in order to counteract HIV/AIDS (market penetration). Also in 2009, Pfizer entered a partnership with the Israeli pharmaceutical company Protalix to develop a drug to treat Gaucher’s disease, empowering its Established Products business. This partnership was Pfizer’s first move into the biosimilar drug market (product development).

Pfizer entered major licensing agreements with three India-based pharmaceutical companies (Aurobindo Pharma Ltd., Claris Lifesciences Ltd. and Strides Arcolab). They add new non-Pfizer products to the portfolio and enhance the access of medicine to underserved people worldwide (market and product development).

A new established partnership with Bausch & Lomb, a global supplier of eye care treatments, allows both companies to promote each other’s prescription ophthalmic products, extending their level of support to eye care professionals (market penetration).

Joining forces with Eli Lilly and Merck, Pfizer established the Asian Cancer Research Group. It is an independent non-profit organization, whose goal it is to gain knowledge of cancers prevalent in Asia and to accelerate drug discovery efforts by sharing the findings with the scientific community (product development).

Moreover, Pfizer teamed up with the innovator in privacy-enhanced search technology, Private Access, in order to raise recruitment into clinical trials by founding the first online community to address privacy concerns, giving participants full control over how much and what information they share with researchers (diversification).

2.1.2 2010

The acquisition of Ferrosan’s consumer healthcare business, a Copenhagen-based consumer health care company concentrating primarily on Northern and recently expanding to Eastern Europe, allows Pfizer to improve its presence on dietary supplements with a new set of brands and pipeline products. This improves Pfizer’s distribution channels in Europe and allows expanding the marketing of Ferrosan’s brands through Pfizer’s global footprint (market penetration).

Pfizer’s acquisition of King Pharmaceuticals, Inc. complements its portfolio of pain treatments in the Primary Care unit and provides potential growth opportunities in the Established Products and Animal Health units (market penetration).

Furthermore, the acquisition of FoldRx Pharmaceuticals, Inc. is expected to increase Pfizer’s presence in the growing rare medical disease market, which complements its Specialty Care unit (market penetration).

The company also created an alliance with the Indian biopharmaceutical company Biocon complementing its Established Products and Emerging Markets unit by advancing in biosimilars and positioning themselves competitively in the diabetes market over time (market penetration). The alliance was cancelled in 2012.

In addition, Pfizer acquired a 40% stake in Laboratório Teuto Brasileiro S.A. (Teuto) to complement their Emerging Markets units, including commercial agreements. This allows the organization to expand its portfolio in generic medicines in Brazil and seize growth opportunities in important emerging markets (market penetration and development).

2.1.3 2011

Towards the end of the year, Pfizer completed the acquisition of Excaliard Pharmaceuticals, Inc., a privately owned biopharmaceutical company focused on developing novel drugs for the treatment of skin fibrosis, more commonly referred to as skin scarring (market penetration).

The company came to an agreement with GlycoMimetics, Inc. for their investigational compound GMI-1070 to receive an exclusive worldwide license to the compound (product development).

Furthermore, Pfizer bought a majority of the shares of Icagen, a biopharmaceutical company focused on discovery, development and commercialization of novel orally-administered small molecule drugs that modulate ion channel targets, resulting in an approximately 70% ownership (market penetration).

The corporation also divested its Capsugel unit for $2.38 billion to private-equity firm Kohlberg Kravis Roberts & Co. to go back to its core pharmaceutical businesses (consolidation).

In the same year, Pfizer acquired King Pharmaceuticals, Inc. King’s principal businesses consist of a prescription pharmaceutical business focused on delivering new formulations of pain treatments designed to discourage common methods of misuse and abuse; the Meridian auto-injector business for emergency drug delivery, which develops and manufactures the EpiPen; an established products portfolio; and an animal health business that offers a variety of feed-additive products for a wide range of species (market penetration).

Moreover, the company announced to explore new strategic alternatives for its animal health & nutrition unit. Those might include a partial or complete separation of this business (consolidation).

2.1.4 2012

Pfizer sold its Nutrition business, including Wyeth’s baby food division, to Nestlé for $11.85 billion. This divestiture allowed Pfizer to concentrate more on its core businesses and Nestlé could improve its position as global market leader in the food industry (consolidation).

Furthermore, the company added NextWave Pharmaceuticals Incorporated (NextWave), a privately held, specialty pharmaceutical company to its portfolio. As a result of the acquisition, Pfizer now holds exclusive North American rights to Quillivant XR™, the first once-daily liquid medication approved in the U.S. to treat ADHD. The total consideration for the acquisition was approximately $442 million (market penetration and product development).

Pfizer and Zhejiang Hisun Pharmaceuticals Co., a leading Chinese pharmaceutical company, engaged in a joint venture, Hisun Pfizer Pharmaceuticals Company Limited (HPP), to develop, manufacture and commercialize off-patent pharmaceutical products in China and global markets (market penetration and development).

In august, the organisation entered into an agreement with AstraZeneca for the global over-the-counter rights for Nexium, a leading prescription drug to treat the symptoms of gastroesophageal reflux disease (product development).

Besides, Pfizer completed the acquisition of Alacer Corporation, a company that manufactures markets and distributes Emergen-C, a powdered drink mix vitamin supplements that is the largest-selling branded vitamin C line in the U.S. (market penetration).

2.1.5 2013

Pfizer completed the full disposition of its animal health business. The full disposition was completed through a series of steps, including the formation of Zoetis, an initial public offering (IPO) (consolidation).

The following Ansoff Matrix marks the most important changes in Pfizer’s portfolio over the last five years:  Figure 9: Ansoff Matrix applied to Pfizer

Figure 9: Ansoff Matrix applied to Pfizer

2.2 Porter’s Generic Strategies

As global market leader in the pharmaceutical industry, Pfizer uses the following two of the generic strategies: differentiation and differentiation focus.

Figure 10: Generic Strategies by Michael Porter

Figure 10: Generic Strategies by Michael Porter

2.2.1 Differentiation Strategy

Pfizer is working in various fields of the pharmaceutical industry, but focusing on biopharmaceuticals and customer health care. A lot of its products, especially in the customer health business unit, are produced for the mass market and therefore indicate a broad target scope. The company spends a lot of money on research and development. In 2013, 12.9% of Pfizer’s revenues were used to fund the companies’ R&D activities. The organization strives for innovation and pioneering the industry. It holds a significant amount of patents (i.e. Lipitor and Viagra), which is decreasing due to expiration of those patents (i.e. Lipitor in 2011). Those products, often becoming blockbusters (prescription drugs that generate more than US-$ 1 billion revenue), allow Pfizer to use their first-mover advantage to offer the products to higher prices, establish their drug and skim revenues before competitors follow. Due to its extensive engagement in R&D, Pfizer is offering innovative and high quality pharmaceutical products all around the world. Furthermore, Pfizer is the global market leader in its industry. To be able to maintain its position, the company needs to keep growing and improving. Besides organic growth, Pfizer engages in partnerships and horizontal integration for future growth. Those partnerships and acquisitions allow the corporation to lower its costs, add new products to the portfolio as well as expanding distribution channels.

2.2.2 Differentiation Focus Strategy

Among the areas of the pharmaceutical industry Pfizer is working on, there are some (i.e. specialty care and oncology), that address a narrow target scope, meaning a special group of customers. Those include cancer patients, infectious and gastrointestinal diseases. The company has increased R&D expenditures especially in those business units to discover new innovative solutions to cure or at least improve patient’s conditions in those domains.

2.3 Gap Analysis

Gap analysis defines the process through which a company compares its actual performance to its expected performance in order to determine, whether it is meeting expectations and using its resources effectively. Gap analysis seeks to answer the questions “where are we?” (current state) and “where do we want to be?” (target state).

For Pfizer we decided to compare the projected revenues of the past five years to the actual revenues achieved. On the graph and table below, one can see that Pfizer managed to surpass its forecasted revenues until 2009. In the year 2010 the company’s revenues were still growing and in 2011 stable. Nevertheless, in both years Pfizer slightly missed its targeted revenues. In the same year (2011), Pfizer’s patent for Lipitor, one of the organisation’s blockbusters used for lowering blood cholesterol and for prevention of events associated with cardiovascular disease, expired. This had a major impact on Pfizer’s revenues, which consequently did not meet the target for 2012 as well as 2013. The years 2013 and 2014 may also be difficult, since the patent for Viagra expired last year as well.

Figure 11: Revenues according to Pfizer financial report 2009-2013

Figure 11: Revenues according to Pfizer financial report 2009-2013

This unfortunate development has led the corporation to adjust forecasted revenues for 2014 and lower projections. In order to get back on track, Pfizer is currently investing quite a lot of money in new partnerships, M&A, R&D and marketing, to add and develop new products to its portfolio as well as intensively promoting the existing ones.

2.4 Life Cycle Analysis

Life cycle analysis can be conducted for industries, companies and products. It is a method to determine in which stage an industry, company or product is at a specific moment. Throughout their life they go through five stages: the introduction stage (here start-up), (rapid) growth, maturity, decline and death stage. In addition, there is a sixth stage, which some companies achieve. Companies, able to relaunch their business during the decline phase, enter the rebirth stage, postponing death. The stages are measured by sales revenue and profits.

Figure 12: Business Life Cycle

Figure 12: Business Life Cycle

As explained in the previous section (gap analysis), Pfizer’s revenues have been decreasing since 2010. The company has a long history and held a lot of patents in the past. Due to the fact of patents expiring and consequently revenues declining, the company can be considered as being at the end of its maturity stage and on the verge to the next stage.

Since Pfizer is at the beginning of its declining phase, the organization will likely be facing a rough time. In order to get back on track, Pfizer is currently investing quite a lot of money in new partnerships, M&A, R&D and marketing, to add products to its portfolio and develop new ones as well as intensively promoting the existing ones. When it succeeds, the company will enter the rebirth stage and revenues will rise again.

2.5 Estimation of the Investment Sufficiency

There are multiple ways to determine investment sufficiency. Unfortunately, a lot of company information is classified and therefore it is very difficult to determine whether or not Pfizer’s investments are sufficient. We chose to indicators to approach this issue. First of all, we compared the organization’s revenues to its expenses in R&D over the past five years. Furthermore, we regarded the development of the share price as well as the dividend yield in the same period.

The following table shows the corporation’s revenues, R&D expenses and the last measured in percent of revenue in the period from 2009 to 2013.

| 2009 | 2010 | 2011 | 2012 | 2013 | |

| Revenues in million $ | 50.009 | 67.809 | 67.425 | 54.657 | 51.584 |

| R&D Expenses in million $ | 7.845 | 9.413 | 9.112 | 7.870 | 6.678 |

| R&D Expenses in percent of revenue | 15.7% | 13.9% | 13.5% | 13.3% | 12.9% |

Figure 13: Pfizer revenues and R&D expenses

As you can see in the table above, as well as in the figure below, R&D expenses have decreased in the same time as Pfizer’s revenues. It is important to note that the percentage of revenue spent on R&D has only slightly changed. Consequently, we can assume that the decrease in R&D funding is mainly due to dropping revenues. The problem is that most of Pfizer’s decrease in revenue can be explained by the recent expiration of patents, followed by customers purchasing similar alternative products.

Figure 14: Revernues and Research & Development expenses according to Pfizer financial report 2009-2013

Figure 14: Revernues and Research & Development expenses according to Pfizer financial report 2009-2013

Moreover, the PhRMA (Pharmaceutical Research and Manufacturers of America), an organization representing the US leading biopharmaceutical researchers and biotechnology companies (including Pfizer), stated that the total R&D expenses as a percentage of total sales of its members was 16.4% in 2012. With 13.3% R&D expenses of total sales in 2012, Pfizer (industry leader by revenues) is spending less than the average. In order to catch up with its competitors in terms of R&D expenses and to stay on top with innovative products in its industry, Pfizer should increase its investments in this department.

Furthermore, you can see on the two graphs below the share price development of Pfizer in the period from 2009 until 2014 as well as the dividend yield for the same period of time.

Figure 15: Pfizer share price 2009-2014 in $

Figure 15: Pfizer share price 2009-2014 in $

As you can see, the share price is continuously rising, except for small plunges in 2009, 2010 and 2011.

Figure 16: Dividend yield according to Pfizer financial report 2009-2013

Figure 16: Dividend yield according to Pfizer financial report 2009-2013

Even though the share price was rising, the dividend yield has been decreasing from 2009 to 2010, and then been rather constant until 2012 and since then it has been decreasing again. We can therefore deduct, that the dividends paid to shareholders have either been rather constant or slightly decreasing, while the share price increased.

In conclusion, Pfizer recorded a decrease in revenues, reduced simultaneously R&D expenses as well as budgets of other departments in order to cut costs and decreased its dividend yield. Overall this indicates room for improvement concerning its investment sufficiency.

2.6 Risk Analysis

Regarding the framework conditions of the global pharmaceuticals industry, the industry moves into uncertain times led by the biggest change in healthcare legislation in the US in 40 years and rising pressures from the loss of patent protection and further industry consolidation. The challenges as well as the risks are greater than ever before. The analysis of KPMG, which analyzed 2009 financial reporting data for the largest global pharmaceutical companies points out a rise in strategic alliances and an increased spending on pharmaceutical drug development on the one side and a decrease in R&D investment on the other side as the industry shifts towards a more challenging cost-oriented environment, though the demand for innovative medicines is growing.

In order to identifying the most probable threats, which could arise inside or outside the organization and to analyze the related vulnerabilities of the company to these threats, a risk analysis is necessary. The major business risk factors disclosed by Pfizer in its 2013 annual report are as follows:

- U.S. Healthcare Reform/Healthcare Legislation

- U.S. Deficit-Reduction Actions

- Pricing Pressures and Government Regulation

- Managed Care Trends

- Generic Competition

- Competitive Products

- Dependence on Key In-Line Products

- Research and Development Investment

- Development, Regulatory Approval and Marketing of Products

- Post-Approval Data

- Patent Protection

- Biotechnology Products

- Research Studies

- Foreign Exchange and Interest Rate Risk

- Risks Affecting International Operations

- Specialty Pharmaceuticals

- Consumer Healthcare

- Global Economic Conditions

- Outsourcing

- Interactions with Healthcare Professionals and Government Officials

- Difficulties of Our Wholesale Distributors

- Product Manufacturing and Marketing Risks

- Counterfeit Products

- Cost and Expense Control/Unusual Events/Failure to Realize the Anticipated Benefits of Strategic Initiatives and Acquisitions/Intangible Assets and Goodwill

- Changes in Laws and Accounting Standards

- Terrorist Activity

- Legal Proceedings

- Business Development Activities

- Information Technology and Security

- Environmental Claims and Proceedings

Many of the named factors can be categorized as regulatory, Intellectual Property, R&D, Global Marketplace or Execution risks. Analyzing every single risk would go beyond the scope of this paper. Therefore selected risks, regarding generic competition, the protection and expiration of intellectual property rights, R&D, regulatory requirements and pharmaceutical pricing will be shortly analyzed in the following section, since they have the highest frequency of risk disclosure within this industry according to a KPMG study from 2012.

A major risk related to intellectual property, which affects especially the pharmaceutical industry is patent expiration and protection. Important revenue is at high risk when a patent is challenged or expires. Replacing these revenue streams increases the need for successful R&D. This is even intensified since an imbalance between new product introductions and patent losses is observed. But with insufficient funds for R&D, pharmaceutical companies, as Pfizer continue to spend more on development and less on research. To counterbalance these risks, an important factor is innovation, which can achieved through M&A activity, the pursuit of developmental collaborative arrangements and the outsourcing of R&D activities. The fundamental importance of intellectual property is emphasized by the fact that the biggest pharmaceutical companies, such as Pfizer, obtain around 50 percent or more of their revenue from just five products.

Besides the patent expiration and protection, generic competition continues to be a significant risk factor for Pfizer as generic companies are aggressively challenging patents and revenue is being lost to generic competition in the face of increasingly strict regulatory requirements. The worldwide pressure on pharmaceutical pricing in terms of competition, price controls and reimbursement reductions, in the face of hard economic conditions features rises.

Furthermore the US Healthcare Reform, which represents the most significant change to delivery and financing of healthcare, poses a high threat on Pfizer. The company has already started to experience decreased revenues and profits attributed to the billions it is ‘taxed’ based on fees and excise taxes. Rebates, discounts, taxes and other costs over time will have a significant effect on Pfizer’s expenses and profitability in the future.

2.7 Investment Portfolio or Investment Program

Regarding the financial investment portfolio, Pfizer has taken and will continue to take a conservative approach to its financial investments regarding both short-term and long-term investments consisting primarily of high-quality, highly liquid, well-diversified and available-for-sale debt securities. Its long-term debt is rated high quality by Standard & Poor’s (S&P) as well as Moody’s Investors Service (Moody’s).

Pfizer put its emphasis on operating cash flows, short-term investments and commercial paper borrowings and long-term debt to provide for its liquidity requirements. The company is able to secure its liquidity needs for the futures through its significant operating cash flows and financial assets, its access to capital markets and its available lines of credit and revolving credit agreements.

Their investment program is made up as follows:

- the working capital requirements of its operations (including R&D activities)

- investments in its business

- dividend payments and potential increases in the dividend rate

- share repurchases

- the cash requirements associated with its cost-reduction/productivity initiatives

- paying down outstanding debt

- contributions to its pension and postretirement plans

- business-development activities

The following table shows certain important measures of Pfizer’s liquidity and capital resources for 2012 and 2013 in its financial report (2013):

Figure 17: Selected measures of liquidity and capital resources in the end of 2013

Figure 17: Selected measures of liquidity and capital resources in the end of 2013

2.8 Strategy Implementation, Planning and Control

Figure 18: Strategic planning, implementation & control

Figure 18: Strategic planning, implementation & control

Strategic planning determines where Pfizer is going over the next year or more, how it’s going to get there and how it’ll know if it got there or not. The focus of a strategic plan is usually on the entire organization (corporate planning), while the focus of a business plan is usually on a particular product, service or program.

Regarding the formal process of strategic planning in a multinational company, such as Pfizer, subsidiaries have to prepare a (division/business/product) plan document. Drawing their strategic plans is based on guidelines provided by the parent institution and they have to be submitted to Pfizer’s headquarters for approval. For instance, Pfizer has a Strategic Planning and Development Division, which prepares a rolling five-year strategic plan for the Indian subsidiary Pfizer India. Moreover there are executive committees consisting of senior level managers who formulate strategic plans.

In the following the major components of strategic planning, in particular strategic implementation of Pfizer, will be presented and analyzed. In order to achieve a competitive advantage, Pfizer has to acquire and use techniques which optimize its core competencies and strengthen its organizational capability. All managers at all levels are involved in the process of strategic implementation, which transforms the strategic plan into action, and finally, into results.

One main step to successfully implement its strategy lies in the ability to use intellectual capital as a major competency better than other pharmaceuticals. It requires Pfizer to change relative to increasing competition, improved information systems processes, advanced technology, and overall increased organizational learning. Moreover managers need to have a broad perspective of Pfizer’s capabilities, so that the implementation of the strategy is managed effectively. Viewing knowledge as a valuable and strategic asset, it is necessary to constantly focus on advanced techniques and innovative means in order to adapt to and to progress in an evolving environment. Decision-making and creativity competencies are essential for effective research, analyses and the development of therapeutics against physical and mental malady. Pfizer requires continual enhancement as to knowledge of inhibitory agents, biological pathways, chemical interactions, and technological processes within the respective specializations, to effectively integrate the astute approaches in developing compounds to eradicate diseases and other ailments.

Pfizer relies on its innate core competencies to research and develop unique compounds, while working to assess environmental factors affecting structural design, and integrating constituencies that contribute to the R&D process. These key actions are based on Pfizers’ strategic goals and planning techniques to implement processes that accommodate current industry perspectives in finally commercializing these therapeutic agents. The strategic implementation is driven by the activities evolving around the employees and the business processes. One important organizational asset would include building internal capabilities to comprise intangible characteristics of conducting scientific research, performing strategic decision-making, employing empowerment, and improving leadership, to provide continual enhancement to the discovery research and development process.

With regard to organizational change it is crucial for Pfizer to build strategic goals and implementation with appropriate adaptation for competing in this knowledge-based industry, such that learning and innovation are increased, and comprise within its structure. Pfizer’s primary objectives require research scientists to incorporate knowledge of relevant facets for long-term perspectives that influence development of therapies encompassing strategies for competing at a comprehensive level. Furthermore increasing competition is forcing Pfizer to be creative in its strategic efforts as businesses are learning to improve the way customers are served.

Products and services that were previously unique in nature are now being imitated, strategic alliances are increasing, technological processes are improving, and pharmaceutical companies are investing more and more in intangible assets. Consequently, to remain competitive, Pfizer needs to sustain organizational capabilities to enhance strategic implementation. Having superior core competencies and organizational capabilities that competitors cannot replicate are key factors for proficient strategy execution. The core competencies of Pfizer must relate to any of its strategic relevant characteristics. Essentially, Pfizer has core competencies of knowledge and experience in the various disease specializations for the purpose of researching and developing drugs in a preventive or protective mode. These competencies require continual improvements for strengthening of the organizational capability, by encouraging innovation and knowledge transfer throughout the R&D functional units. To attain organizational capabilities for the implementation of organizational strategy, Pfizer must firstly, ensure its scientists to possess keen expertise and experience within the relevant research concentrations for which it builds its goals, and further, organize and coordinate research programs with key resources to meet these objectives, with increased ability to effectively adjust to the dynamics of innovative thinking and execution to produce medical therapeutics. It is critical to continually improve the intellectual capital and to base strategic implementation on this area due to potential replication of industry rivals and the potential to always react to changes in the environment. As more knowledge is transferred and institutionalized, Pfizer’s capability is more likely to be increased as a competitive advantage. Pfizer has to continually provide support to senior management, who generally possess strengths as scientists to discover methods to combat diseases, and minimal skills to build and strengthen the intellectual capital to achieve competitive advantage through exceptional strategy execution.

Effectively managing intellectual resources are another crucial part of strategic implementation. By having superior intellectual resources, Pfizer must understand how to exploit and develop their traditional resources better than competitors. The implication of this perspective is that the value of the intellectual capital exists with the knowledge of the individuals, but can be institutionalized, as part of the organization’s systems and structures. Pfizer has to concentrate its efforts toward developing more creative skills for research science professionals, as well as enhanced managerial competencies. Pfizer is improving its intellectual capital by building structures and a leadership system that help create, acquire and transfer knowledge throughout the organization, while empowering all employees to be decision-makers in the strategic implementation process.

Following strategic planning and implementation, strategic control usually deals with five aspects of organization, which are structure, leadership, technology, human resources and information and operation control systems. Within this context Pfizer periodically assesses its organizational structure in order to determine whether it is achieving its strategic goals by evaluating key performance indicators and analyzing their deviations from planned/forecasted values. Pfizer monitors performance against defined goals and includes metrics tied to performance. Strategic control is therefore about the extent to which implemented strategy achieves strategic goals. If one or more implementation steps are preventing the attainment of strategic goals, it has to be adjusted / changed by altering its structure, replacing key leaders, adopting new technology, modifying human resources or changing its information and operational control systems.

Put into concrete example, Pfizer has invested billions of dollars in R&D for years, and didn’t realized until some time ago that it is not receiving an adequate return on Investment. For a long time Pfizer has a strategy of in-house product development and employed staff of several thousand researchers. As a consequence 800 senior researchers were laid off. Pfizer also announced a strategic reorientation by acquiring new drug formulas and patents simply bought by other smaller drug companies, which would be more cost-effective. To sum it up strategic control is about making sure that strategies are well implemented, and poor strategies are modified or scrapped.

2.9 Action Plan

The purpose of the action plan is to translate the corporate strategy into “action”. In order to do this specific functional tactics and actions, the time frame for completion and the immediate goals have to be provided (at least). The action plan in the table below shows a sample of some of the goals and resources, as well as planned actions and a respective time schedule that will facilitate Pfizer to achieve its strategic goals.

| Objectives | Actions and Tactics | Schedule |

| increase efficiency and effectiveness |

|

2014 -2016 |

| cost-savings |

|

2014 -2016 |

| increase revenue |

|

2014 |

| develop new generation of blockbuster drugs |

|

from 2014 onwards |

Figure 18: Action plan Pfizer

2.10 Performance Measurement

2.10.1 Balanced Scorecard

The balanced scorecard (BSC) is a strategy performance management tool that identifies and improves diverse internal functions and their resulting external outcomes in an attempt to measure and provide feedback to the company in order to assist in implementing strategies and objectives.

Pfizer uses a Balanced Scorecard approach that evaluates both financial as well as non-financial measures. Practically relevant information and performance data of Pfizer are collected via an online system and used as part of formal mid-year and annual evaluation.

The Business Unit Pfizer’s Global Operations (PGO) is in charge of leveraging scorecards to drive the integration efforts of various acquisitions and to ensure the capture of best practices throughout Pfizer. As per PGO, a successful integration depends on unifying all employees behind a single set of strategic objectives. By starting with strategy and the vision, Pfizer’s workforce has a clear understanding of the criteria and parameters to use in driving integration activities and designing go-forward business processes, therefore the Pfizer’s strategic objectives provide the ‘‘right’’ pathway to follow and a framework for the organization’s scorecard efforts. Though various criteria are used to determine scorecard measures, the most important criterion is the metric which links directly to a strategic objective and support and drive the attainment of strategy.

Figure 19: 360 Review Process – The Balanced Scorecard Approach

Figure 19: 360 Review Process – The Balanced Scorecard Approach

A sample of goals and measures with regard to the application of the BSC on Pfizer are presented below and are mainly based on given information of the previous chapters:

| Goals | Measures | |

| FINANCIAL PERSPECTIVE |

|

|

| CUSTOMER PERSPECTIVE |

|

|

| INTERNAL BUSINESS |

|

|

| LEARNING & GROWTH |

|

|

Figure 20: Goals and measures with regard to the application of the BSC of Pfizer

2.10.2. Value based management

The focus of value-based management is to increase the company’s value. This includes complete information on the company. It is important that all departments of the operation are included. Value increases are possible, for example by increasing the operating profitability. This can be achieved by reducing costs or raising prices.Through the sale of non-required assets, one may also achieve an increase in productivity of capital.Furthermorelowering the cost of capital contributes to increase the company’s value.

One possible method to determine the company value is the economic value added (EVA). The EVA indicates whether a company made a profit that exceeds the cost of capital. In order to calculate the EVA, one has to take a look at the Pfizer’s returns on invested capital after measuring the cost of obtaining it and of keeping investors’ capital tied up in its business. According to its recently reported quarter Pfizer showed $106.77 billion in invested capital, on which it obtained a 16.03% return based on 12-month trailing operating income. In the same period its total after tax cost of capital was 6.78%, most of it related to its weighted cost of equity, which was 5.96% vs. its 0.82% weighted cost of debt. By deducting these costs from the total return on investment, Pfizer’s EVA accounts for 9.25%. Though this value is not outstanding, it still represents an acceptable economic profit after accounting for both operating as well as capital costs.

Thank you for reading. Please comment in case you have additional information.

Excellent research stuff for my Master in strategic management module named marketing strategy

You are welcome. Thank you very much for the flowers!

Awesome page, Carry on the wonderful work. Thanks for your time!

Thanks!

WOW excellent work. Great SMART information on Pfizer

Thank you very much for the kind words!

very helpful page, thank you very much for your efforts

You are welcome!

I wish I could have ended up on this page before. Anyways really good stuff.

Thank you!